Daily Finance and Company News (Page 6)

Consolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

New FICO Credit Score Changes: Some Will Soar, Other Will Crash

A handful of small tweaks will have a huge impact on Americans’ credit scores – some for the better. Including…

Student Loan Reform: Repaying Student Loans May Get Easier in 2020

Several options are up for debate on Capitol Hill, but will they be enough to help borrowers? Student loan debt…

Hindsight is 2020: How to learn from money mistakes

Even experts make money mistakes. Learn from our panel about money missteps and how you can learn from them and…

Retirement Savings Updates: The Impact of the SECURES Act

On January 1, 2020, the Setting Every Community Up for Retirement Enhancement (SECURE) Act officially became law. This important legislation…

Consolidated Credit Hosts Fall Florida Homebuying Fair

2019 Florida Homebuying Fair helps homebuyers assemble the right team to achieve their dreams of homeownership. Buying a home is…

14 Single Parents and Financial Experts on Money Challenges

Managing finances as a single parent is no joke. You’re responsible for making money, budgeting, paying bills, and saving for…

Avoid Vampire Energy and Save Money This Halloween

Don’t let the costumed kids spook you too much this year – the real scare comes from the electricity vampires…

19 Experts Respond: Teens, Money and Financial Independence

Sometimes school education comes up short when it comes to teaching young people real fiscal responsibility. That’s where parents come…

Veterans to Qualify Automatically for Permanent Disability Student Loan Forgiveness

The Department of Education and VA will now coordinate to eliminate all paperwork required for disabled Veterans to qualify student…

10 Experts Answer: Overcoming the Challenges Women Face with Money

Women face many challenges where money, financing, investing and earning are concerned. The pay gap, children, work-life balance, and having…

What Happens When the Fed Lowers Interest Rates?

Whether you’re focused on saving, paying off debt or both, the latest Federal Reserve rate announcement may impact your strategy.…

What to Do After a Credit Card Data Breach

Over 100 million Americans may be affected by the latest data breach. Here’s what you need to do. On Monday,…

Read This If You Were a Victim of the 2017 Equifax Data Breach

Equifax may compensate victims of the data breach if a federal court approves a proposed class action settlement. If you…

Budgeting for Christmas in July

The year is half over, it’s time to start budgeting for the holidays now! These days, with Amazon Prime Day…

Is Your Debt-to-Income Ratio Telling You It’s Time to Get Debt Help?

If your DTI is over 36 percent, then it’s time to act and find debt relief. It’s a question that…

Military Families: Learn to Take Control of Your Financial Life

Consolidated Credit Solutions is hosting a three-part seminar to teach military service members, veterans, and their families how to navigate…

Consumer Credit Card Debt Breaks Records… Again.

U.S. consumers owe credit card companies $870 billion. Here’s what you can do to eliminate your piece of that pie.…

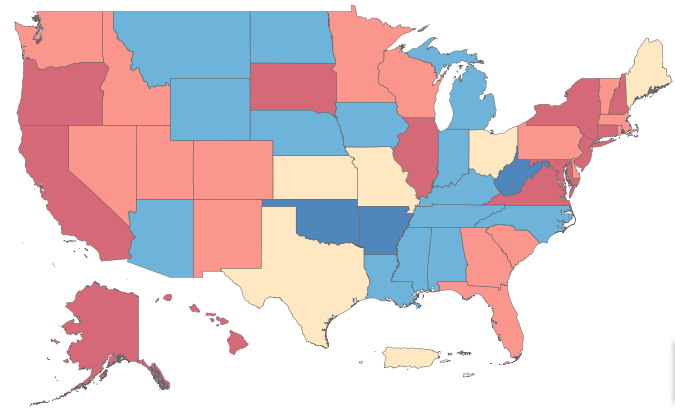

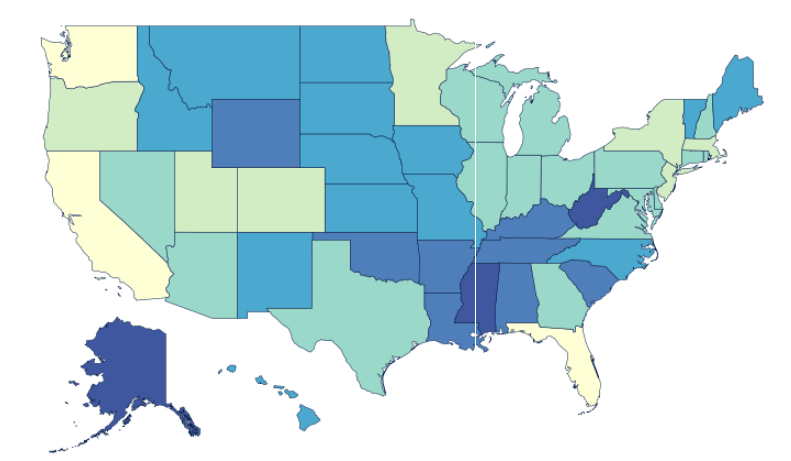

A Snapshot of Credit Card Debt by State in 2019

California has the most credit card debt in total, but Nevada had the biggest gains over a year. Consolidated Credit…

Attention Federal Employees: Free Help with Credit Card Debt During Government Shutdown

If you’re taking on credit card debt to cover expenses during your furlough, there are steps you can take to…

Figuring out the Finances of the Government Shutdown

Find out what the FDIC has to say about getting through the shutdown with your finances intact. Our government is,…

5 Good Reasons to Call Your Credit Card Company

Customer loyalty can be turned into cost-savings when the time is right. A financial expert named Matt Schulz shared an…

What to Do If You Receive an Unexpected Emergency Room Bill

Millions of Americans could face unexpected medical bills in January. Medical debt is now the leading cause of bankruptcy in…

Despite Economy, Employees are Struggling with Debt

The proven solution? Knowledge of Financial Education Last month, the world’s second-largest professional services company released a first-class study about…

Two Major Creditors Scale Back on Customer Credit Card Limits

Tougher lending standards may mean lower limits on new credit cards. Two of the biggest credit card companies in the…