Daily Finance and Company News (Page 4)

Consolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Consolidated Credit Helps South Florida Renters Apply for Emergency Rental Assistance

In late August, the U.S. Treasury issued an update on the Emergency Rental Assistance Program (ERAP). The news was not…

Consolidated Credit Helps Couples Learn How to Talk about Money

Two out of three couples start their marriage in debt, according to a report by the Federal Reserve. Disagreements on…

Finding Work-Life Balance in the New Normal

Significant historical events, from the Great Depression to WW2, changed our society in unimaginable ways. The Great Depression gave us…

Adjusting Your Budget as You Return to Work

Now that the pandemic is (almost) over, the days of working from home should be coming to a close. Offices are…

Learning to Avoid Common Money Mistakes

As our nation comes out of the pandemic, many of us are looking at our money habits and trying to…

What Parents Need to Know about the Advance Child Tax Credit [Updated July 2021]

Advance payments for the expanded Child Tax Credit started on July 15. Millions of eligible parents have already started to…

Free Webinar: Which Student Loan Repayment Plan is Right for You?

The emergency forbearance on student loan payments is expected to end in October. Americans owe more than $1.5 trillion in…

National Homeownership Month 2021: How Do Homebuyers Overcome the Home Affordability Gap?

June is National Homeownership Month, a month that celebrates home ownership and encourages people to reach for the American Dream.…

Should You Buy or Refinance Your Home?

Whether you’re buying a new home or refinancing your current one, your finances need to be in shape. Mortgage interest…

Are You Prepared for a Natural Disaster?

Storm season is almost upon us. It’s time to get prepped to avoid a financial disaster. After a record-breaking storm…

Overcoming the Unique Financial Challenges that Come with Military Service

April is Military Saves Month. It’s a month dedicated to raising awareness about the unique financial challenges that military personnel…

Consolidated Credit Announces a New Virtual Small Business Workshop Series

Teaching startups and entrepreneurs the ropes for running a small business Consolidated Credit and Comerica Bank will host a new…

Learning How to Survive Financial Stress

Even though life hasn’t entirely changed back to normal, Americans’ perspectives on their finances have changed—and in a good way.…

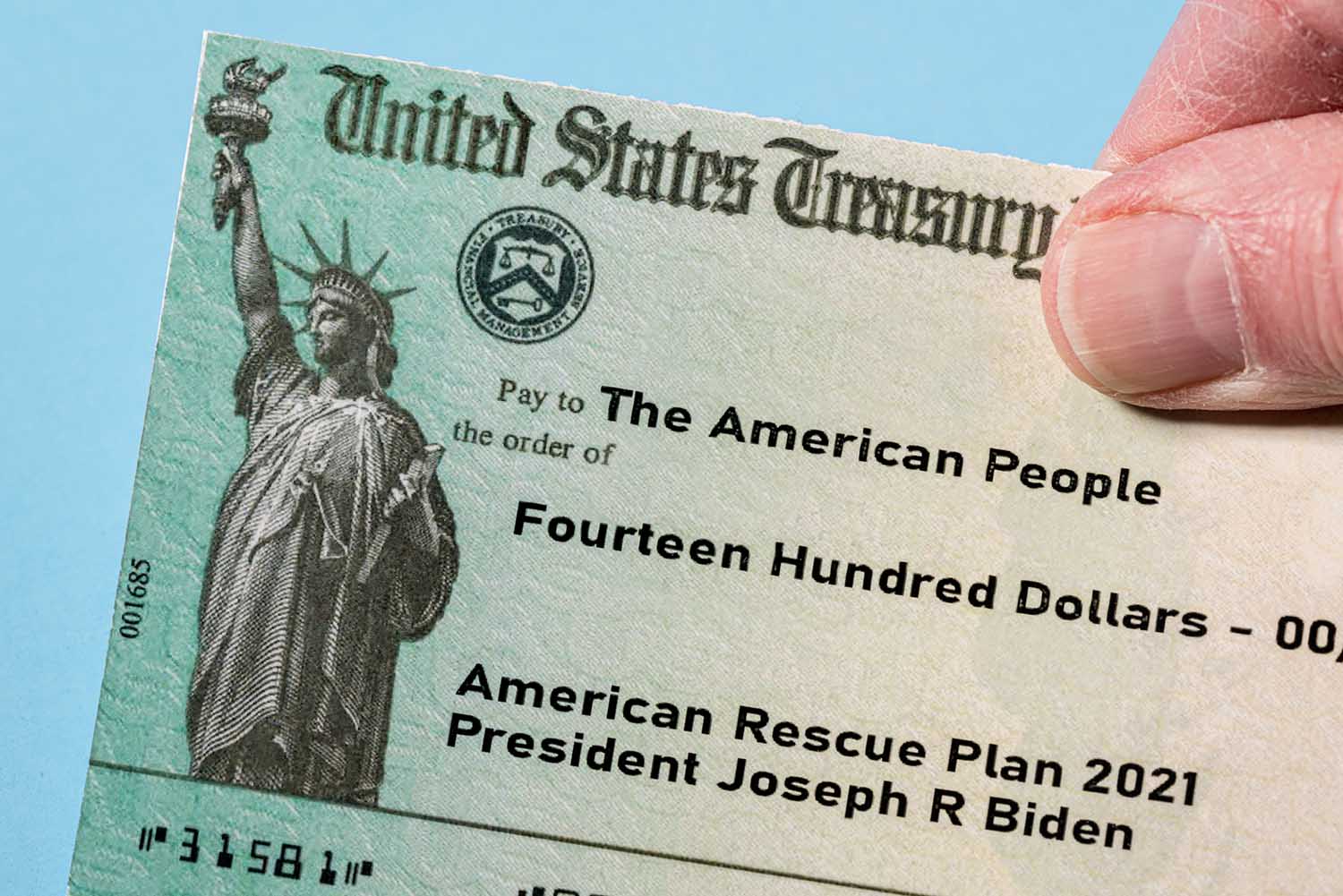

How to Get Your Stimulus Check if You Don’t File Taxes

You can still get your payments, but it may require filing taxes this year. Millions of Americans have already received…

Third Stimulus Leaves Americans Vulnerable to Garnishment

Congress has passed another landmark $1.9 trillion relief package to help Americans recover from this financial crisis. However, a technicality…

Overcoming Financial Infidelity: Couples Get Honest about Money

Between stay-at-home orders, more work from home hours, and school closures for kids, the pandemic has created plenty of new…

What’s the Best Debt Solution for You?

Finding the most effective method to get out of debt. If your goal this year is to pay off debt,…

Survey: Consolidated Credit Clients are Financially Surviving the Pandemic

Consolidated Credit asked more than 1,000 Americans about their finances this year – and found that clients are doing much…

Second Stimulus Offers More Debt Relief for Americans

A new round of stimulus may lead to another drop in consumer credit card debt. Many Americans are waking up…

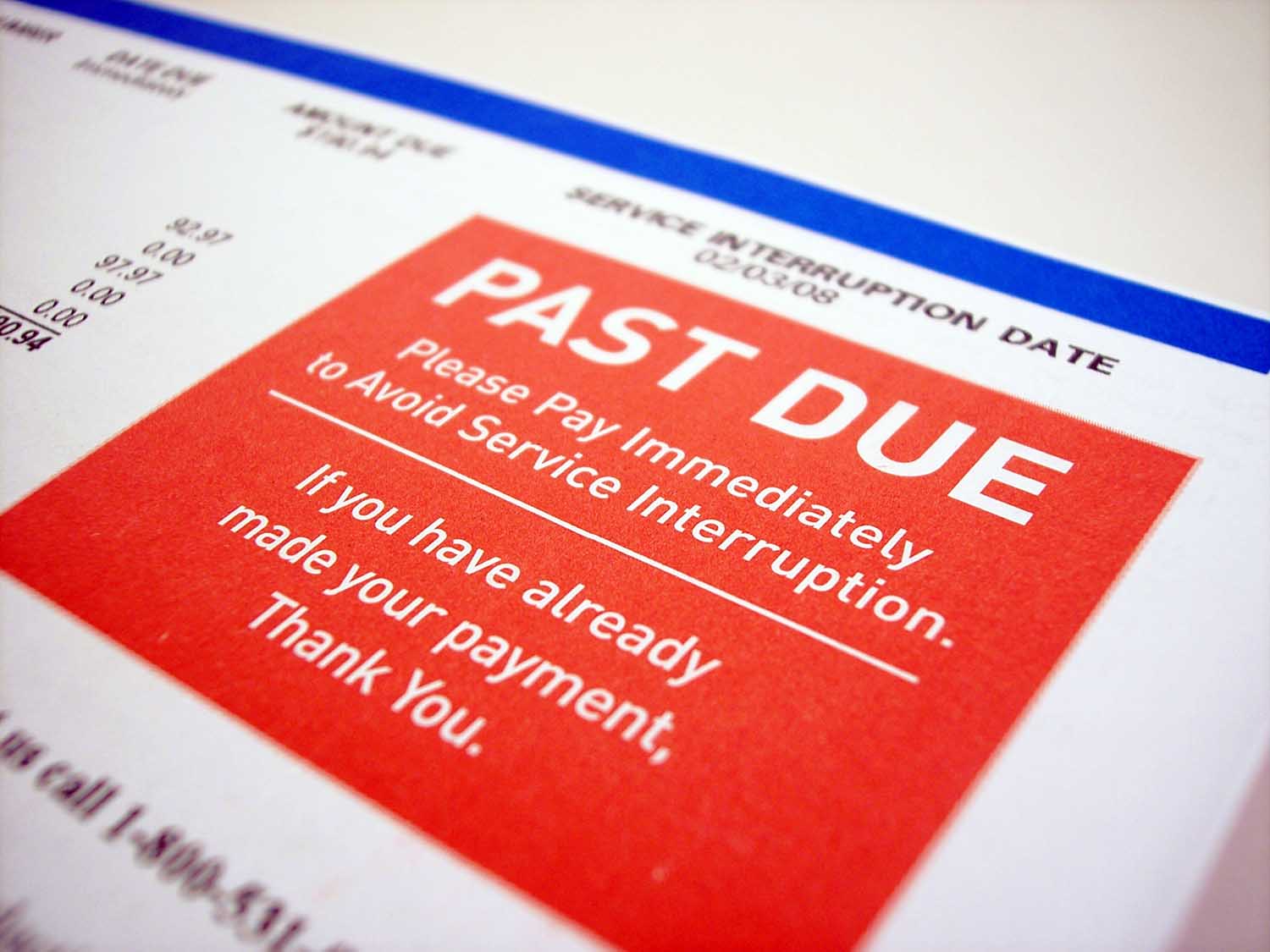

Americans May Face a Crisis with Past Due Debt

Credit card defaults and delinquencies are expected to rise next year. If you focus solely on cold numbers, it looks…

December Webinar: Find 10 Smarter Way to Save

Since the start of the pandemic, the amount of personal debt in the United States has gone down — and…

Navigating the World of Credit Cards

This month, our free webinar will cover different types of credit cards, how to read your statement, and how to…

Americans Adjust Their Credit Habits as a Result of the Pandemic

Households are paying off record debt but are still forced to rely on credit. The pandemic has had a significant…

Credit Unions Help Hispanic Americans Access Key Financial Services

These member-focused financial institutions offer a practical alternative to traditional banks. Most Americans take access to banking and financial products…

![What Parents Need to Know about the Advance Child Tax Credit [Updated July 2021]](https://www.consolidatedcredit.org/wp-content/uploads/2020/01/Father-Teaches-Daughter-to-Save-thumbnail.jpg)